In order to facilitate the ability of lenders to floor plan or otherwise finance the acquisition of inventory by dealers of titled equipment the ucc in almost all states provides that filing a financing statement is the proper method of perfection d uring any period in which collateral subject to a state certificate of title law is.

Floor plan lending ucc.

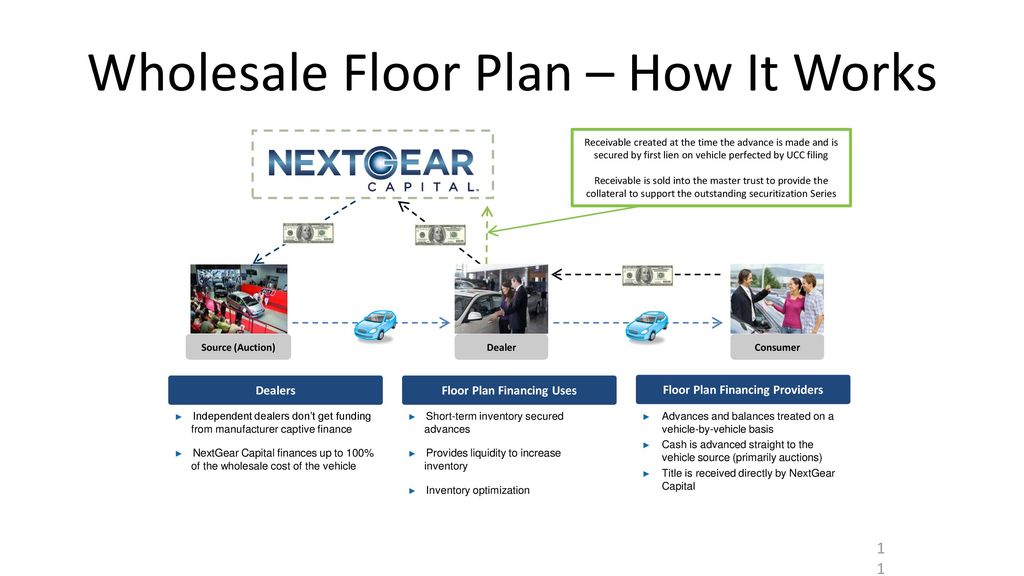

Floor plan lending is a form of inventory financing for a dealer of consumer or commercial goods in which each loan advance is made against a specific piece of collateral.

Uniform commercial code ucc requires a bank to enter into a security agreement with the.

For example a dealer might be able to borrow 10 million over the year to purchase 300.

Supplementing working cash with a floor plan is a tried and true method to grow business.

The dispute arose because the floor plan lender refused to turn over possession of the certificate of title.

As each individual new car is shipped to the dealer it is an industry standard practice that the manufacturer drafts the.

This booklet addresses the risks associated with floor plan lending and discusses risk management practices for floor plan lending.

Floor planning is a form of financing for large ticket items displayed on showroom floors.

Floor plan lenders include local and regional banks large national banks and financing companies owned by the manufacturing companies like toyota financial or ford credit.

The loans are often made with a one year term and based on an aggregate budget.

Find out how nextgear capital dealers are tackling the challenges of today s market head on by properly utilizing their lines of credit.

Although the lender filed a ucc 1 financing statement to perfect its lien the floor plan loan agreement also required all original vehicle title documents to be transferred to and held by the lender.

The nationwide industry standard process is called floor plan lending and it works like this.

Floor plan financing is also done for large appliances mobile homes and boats among other items and these products are usually sold to consumers with a financing contract.

The debtor later filed for bankruptcy and the lender continued to hold the certificates of title after subsequent sales to consumers as a means.

When a certificate of title is not transferred to the buyer the court in bank one found that a buyer s purchase of a vehicle was not sufficient.

The dealer then receives payment hopefully including a profit and remits the balance to the lender who in turn releases the title to the car to the new purchaser.

For example automobile dealerships utilize floor plan financing to run their businesses.